Fed Cuts Again

The US Dollar is stabilising today after a sharp sell-off yesterday in response to the December FOMC. The Fed cut rates by .25% as expected and was a little more dovish than many were expecting. Ahead of the meeting there was plenty of chatter around a ‘hawkish cut’ with many players looking for the Fed to cut rates by a thin majority while signalling that further easing was unlikely near-term. However, 10 members were seen voting in favour of the cut (with one pushing for a larger .5% cut) and only two voting for a hold. This was a more dovish skew than expected, informing the sell off we saw in USD.

Rate Expectations

Looking ahead, Powell noted that a rate hike was not on anybody’s radar with the bank expecting to either cut rates or hold them steady. The update dot plot forecasts show at least one projected cut in 2026 and again in 2027. As expected, Powell placed a lot of emphasis on incoming data which the Fed will respond to. However, Powell did warn that near-term data would likely be distorted by the US govt shutdown.

NFP Data Up Next

Focus now turns to the incoming October/November NFP data sets due next week. If we see any further weakness in the labour market, this should keep USD skewed to the downside, keeping Q1 2026 rate cut expectations in focus. Any upside surprises in the data should cause some pushback against calls for an early 2026 rate cut, leading USD higher again.

Technical Views

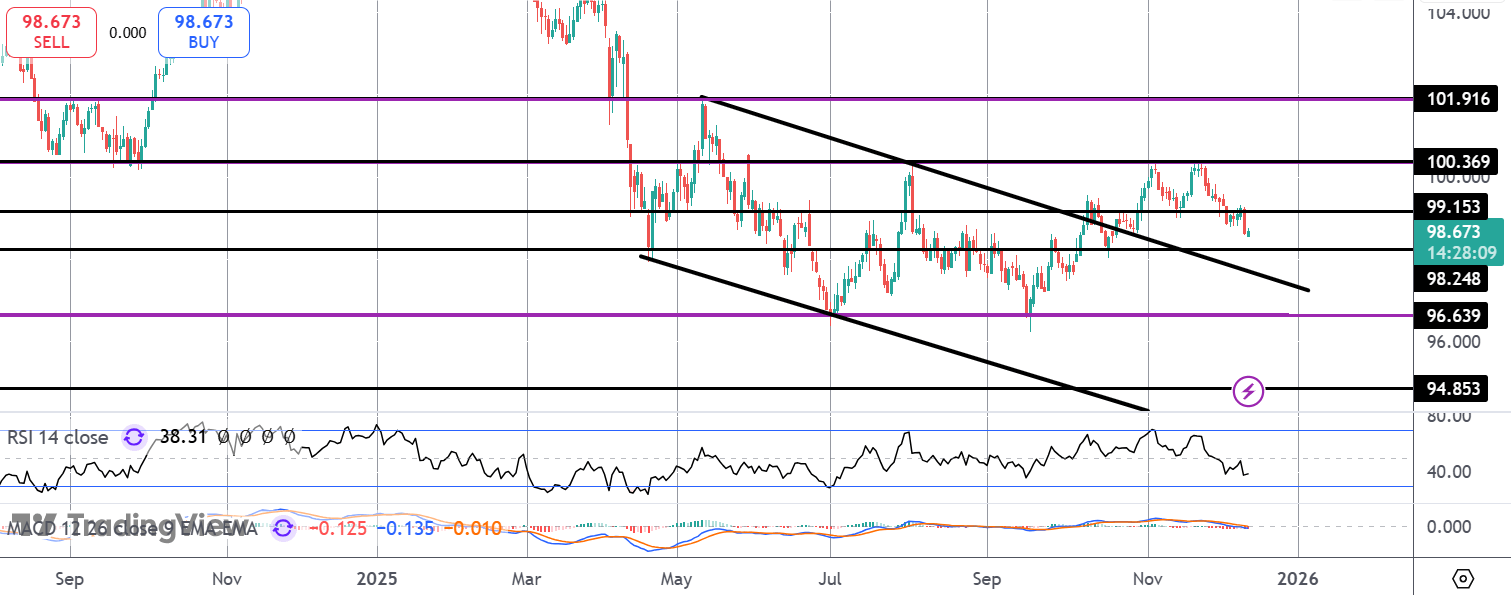

DXY

The sell off in DXY has seen price falling back under the 99.15 level. Price is now fast approaching a test of the 98.24 level and retest of the broken bear channel highs. This will be a key pivot for the market with bulls needing to defend this zone to prevent a deeper drop towards 96.63 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.