Fed Cuts Rates Again

The US Dollar remains well bid today despite the latest rate cut form the Fed yesterday. The October FOMC saw the central bank cutting rates by a further .25% as expected. However, revelations from Powell that sentiment among policymakers was highly divided over further easing this year prevented USD from selling off in response to the cut.

Powell Highlights Mixed Views

In the post-meeting presser, Powell note that a further cut in December was not a foregone conclusion, pushing back against market pricing which was sitting around 95% ahead of the FOMC. On the back of those comments, pricing for a furtehr cut in December has dropped to around 70%. Much of this decision over future easing was based on the lack of labour market data available to the Fed amidst the ongoing US govt shutdown. With the Fed unable to get a proper read on whether labour market conditions have deteriorated further, many members felt unable to commit to furtehr easing. With this perspective now on the table, USD looks unlikely to move lower near-term as traders eye a December cut with uncertainty.

US/China Trade Deal

Alongside a less dovish tone from the Fed, USD is also being supported by positive news on the US/China trade front. Following a meeting in Korea yesterday, Trump and announced a deal on tariffs and rare earths access for the US. The current suspension of trade tariffs, due to end on Nov 10th, will now be extended for another year in exchange for China agreeing to crackdown on the fentanyl trade and resuming purchases of US soybeans.

Technical Views

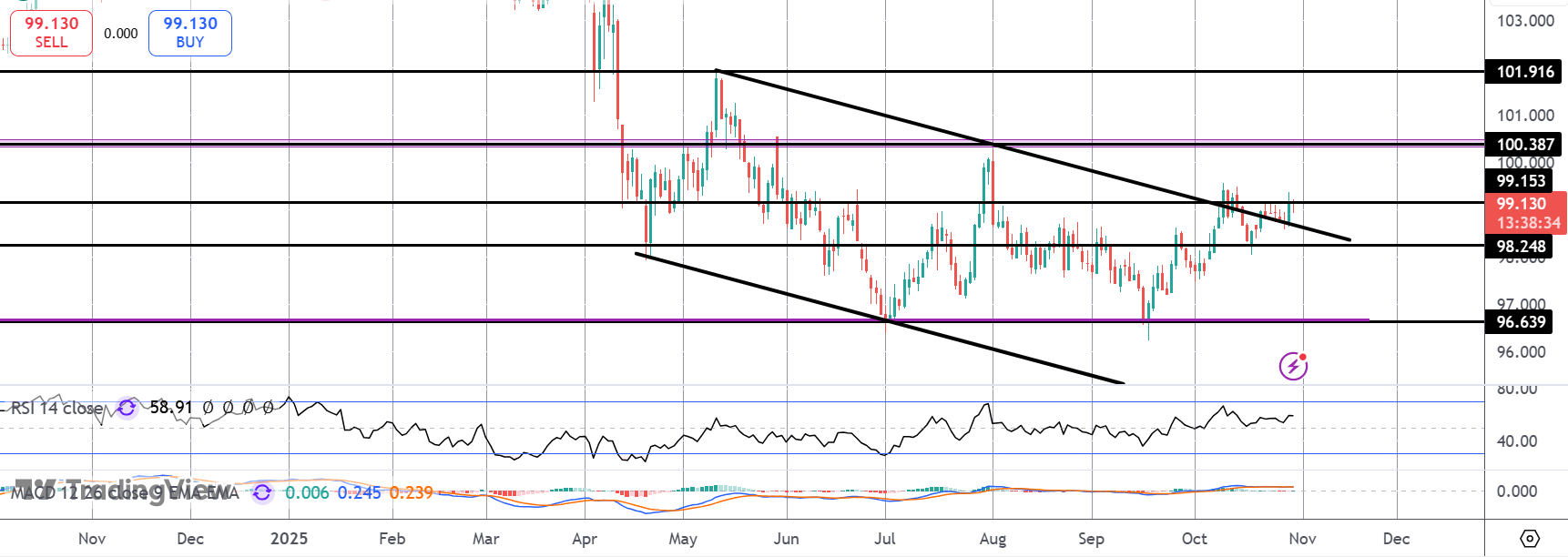

DXY

The index is once again testing the 99.15 level following a solid rally of the broken bear channel highs. If bulls can break above this level focus will be on a test of the 100.38 market next and the summer highs. To the downside, 98.24 remains key support to watch with the bull view only shifting on a break below that level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.