SP500 LDN TRADING UPDATE 11/9/25

SP500 LDN TRADING UPDATE 11/9/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! CASH US500 EQUIVALENT LEVELS SUBTRACT ~10 POINTS***

WEEKLY BULL BEAR ZONE 6440/50

WEEKLY RANGE RES 6556 SUP 6407

SEP MOPEX STRADDLE - 6260/6639

SEP EOM STRADDLE - 6282/6638

DAILY BULL BEAR ZONE 6510/00

DAILY RANGE RES 6595 SUP 6478

2 SIGMA RES 6656 SUP 6416

VIX DAILY BULL BEAR ZONE 15.75

DAILY MARKET CONDITION - ONE TIME FRAMING UP 6522

One-Time Framing Up (OTFU): This represents a market trend where each successive bar forms a higher low, signaling a strong and consistent upward movement.

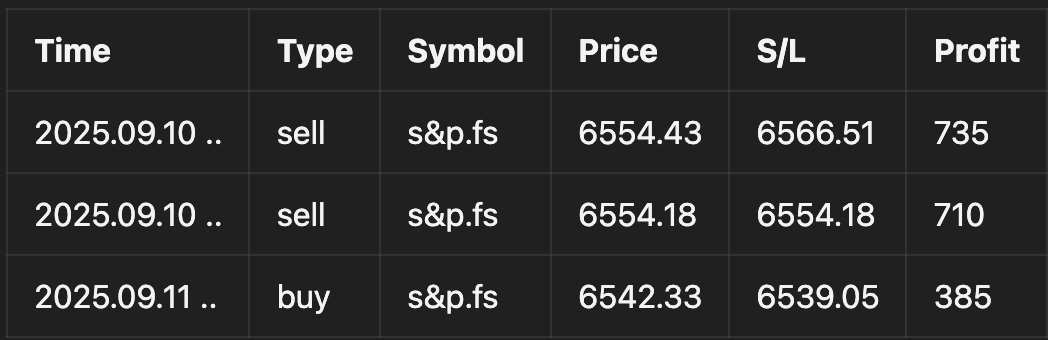

TRADES & TARGETS

LONG ON TEST/REJECT DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT OF DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE AT OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS

U.S. EQUITIES UPDATE: TECH CHASE

FICC and Equities | 10 September 2025 |

Market Overview:

- S&P 500: +30bps, closing at 6,532 with a MOC of $2.1B to BUY.

- NASDAQ 100 (NDX): +4bps at 23,849.

- Russell 2000 (R2K): -21bps at 2,379.

- Dow Jones: -48bps at 45,490.

- Volume: 17.4B shares traded across all U.S. equity exchanges, above the YTD daily average of 16.8B shares.

Key Metrics:

- VIX: +206bps at 15.35.

- WTI Crude: +174bps at $63.72.

- U.S. 10-Year Yield: -4bps at 4.04%.

- Gold: -4bps at 3,680.

- DXY: +6bps at 97.84.

- Bitcoin: +66bps at $113,752.

Tech Sector Highlights:

What a day for Oracle (ORCL), surging +36% post-earnings last night. The company reported a significant increase in AI-driven contract volume and announced a massive $300B contract with OpenAI this afternoon. The pace and scale of positive AI updates continue to fuel a strong near-term rally in tech stocks.

Our tech pad saw broad buying interest from both long-only (LO) and hedge fund (HF) communities, with substantial buy waves concentrated in AI infrastructure. Selling activity was limited, primarily sourced from non-AI software names. Healthcare lagged notably, pressured by the source-of-funds dynamic.

Macroeconomic Insights:

Yields eased following softer-than-expected PPI figures, with declines in headline and ex-food/energy metrics aligning with expectations. Tomorrow brings CPI data, with GIR projecting core CPI at +0.36% (vs. +0.3% consensus). Straddle pricing for tomorrow screens at ~58bps, marking the lowest implied move for CPI this year.

IPO Activity:

The IPO window remains robust. Klarna (KLAR) priced at $40 and opened at $52. Next up: FIGR tomorrow, followed by GEMI, VIA, and LGN on Friday.

Floor Activity:

Activity levels on the trading floor were rated a 7 out of 10. The floor finished +80bps to buy versus a 30-day average of -32bps. Long-only investors ended as net buyers (+$1B), with demand heavily focused on tech and AI themes. Hedge funds were slight net sellers, showing demand in industrials and tech while trimming macro products and discretionary names.

Derivatives Strategy:

We continue to favor QQQ short-dated topside as attention pivots back to the AI trade. October topside trades at ~3.4v premium over equivalent SPX volatility. We recommend long volatility and short skew in SPX, alongside short SPX calendars. With the street long gamma on the downside, long vol trades should focus on the call wing.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!