SP500 LDN TRADING UPDATE 16/12/25

SP500 LDN TRADING UPDATE 16/12/25

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

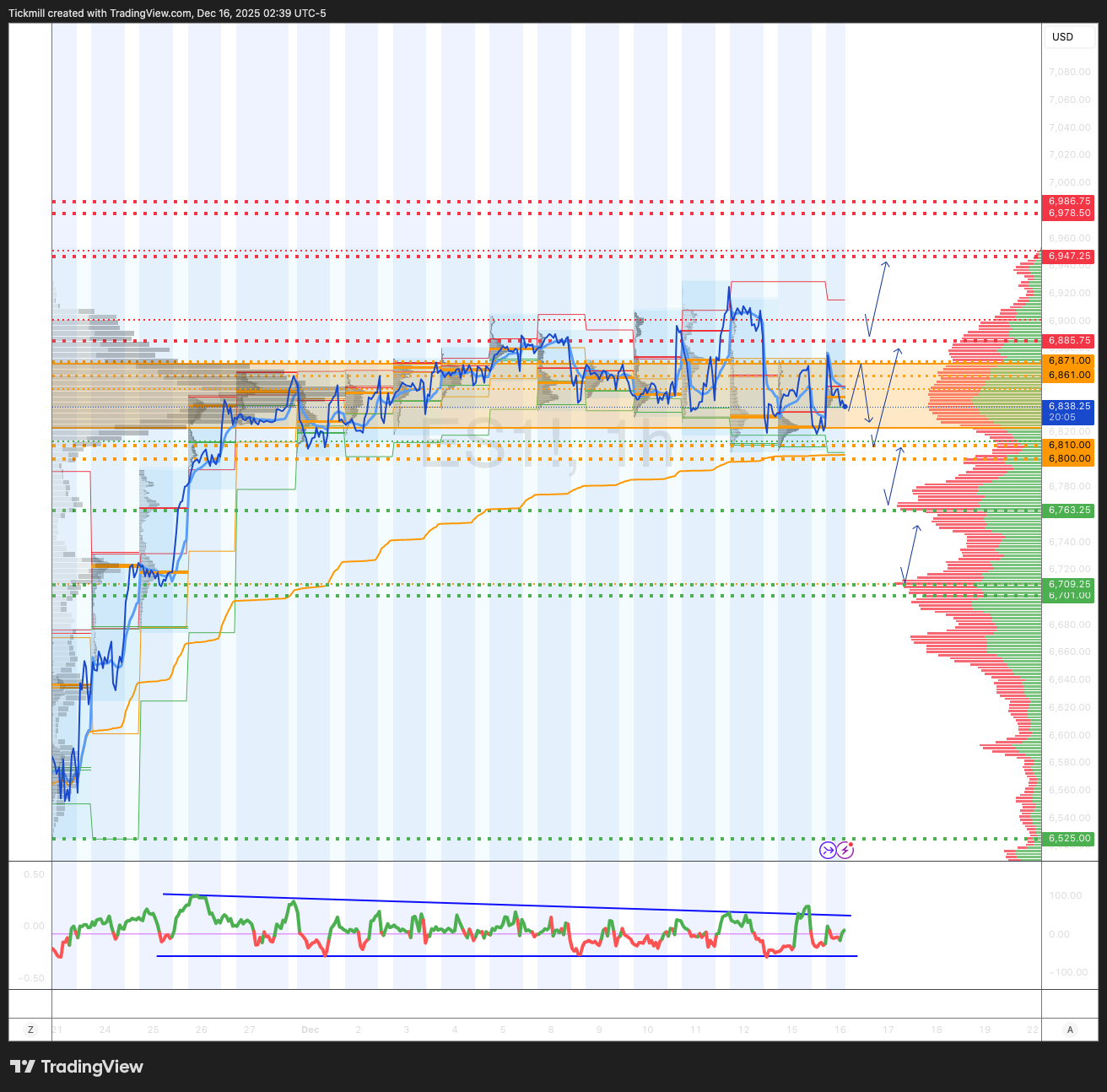

WEEKLY BULL BEAR ZONE 6810/00

WEEKLY RANGE RES 6940 SUP 6725

DEC EOM STRADDLE 6631/7067

DEC QOPEX STRADDLE 6303/7025

WEEKLY VWAP BULLISH 6766

MONTHLY VWAP BULLISH 6764

WEEKLY STRUCTURE – BALANCE - 6805/6909

MONTHLY STRUCTURE – BALANCE - 6952/6539

The week opens in a negative gamma regime with zero gamma ES ~6820). Below this, price is more sensitive and prone to sharper moves

DAILY STRUCTURE – BALANCE - 6805/6909

DAILY VWAP BEARISH 6858

DAILY BULL BEAR ZONE 6861/71

DAILY RANGE RES 6886 SUP 6763

2 SIGMA RES 6947 SUP 6701

VIX BULL BEAR ZONE 18.36

PUT/CALL RATIO 1.21

TRADES & TARGETS

SHORT ON TEST/REJECT DAILY BULL BEAR ZONE TRAGET WEEKLY BULL BEAR ZONE

LONG ON TEST/REJECT DAILY RANGE SUP TARGET WEEKLY BULL BEAR ZONE

LONG ON ACCEPTANCE ABOVE DAILY RANGE RES TARGET 2 SIGMA RES

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW

Market Intelligence: Pause Means Pause?

15 December 2025

US Market Update

US stocks remain relatively unchanged on Monday as investors digest last week’s Federal Reserve meeting and prepare for Tuesday’s dual Payrolls reports (October and November). These reports are expected to play a crucial role in shaping the Fed’s next policy decision.

The Road Ahead: Earnings or the Fed?

This year’s ‘Santa Rally’ faces challenges, with investors navigating the aftermath of the government shutdown, a deluge of economic data, and a Federal Reserve grappling with internal dissent and an impending leadership change. Despite last week’s FOMC statement and comments from Fed Chair Powell, markets showed little reaction—10-year Treasury yields have remained stable, and the S&P 500 has dipped marginally by ~15 points (~0.2%).

However, the Fed’s influence on markets is far from over. Tomorrow’s Payrolls reports are expected to provide critical insights. Economists predict a slightly above-consensus 55,000 non-farm payroll additions for November, with the unemployment rate projected to rise by 10 basis points to 4.5%.

Economic Data Snapshot

The Empire Index, the first of the regional business sentiment surveys, indicates a decline in optimism. The index fell to -3.9 from +18.7 last month, signaling mixed-to-weak business conditions. While new orders and shipments decreased, the employment component edged up, and the expected prices received component reached its highest level since April 2022.

Investment Strategy Amid Uncertainty

Ben Snider highlights the opportunity in pro-cyclical stocks, emphasizing that the anticipated economic acceleration in 2026 is not yet fully priced into the market. Stimulus measures and easing financial conditions are expected to drive growth, with economists forecasting 12% EPS growth for the S&P 500 and a 2.5% GDP increase in 2026.

Sector Outlooks for 2026

1. Semiconductors:

Jim Schneider’s recent trip to Asia reinforces his confidence in sustained hyperscaler capex trends through 2026. Key takeaways include strength in the optical networking sector and rising input costs for PCs and smartphones as AI customers dominate the market. Recommended stocks: AVGO, NVDA, CDNS, AMAT, and TER.

2. Hotels and Casinos:

Lizzie Dove favors high-end hotels over casinos for 2026, citing RevPAR acceleration and new room additions. Upgraded to Buy: MAR and HLT. For casinos, Macau and Singapore are preferred over Las Vegas due to robust gross gaming revenue growth. Upgraded to Buy: LVS.

Internet Stocks: 2026 Themes

Eric Sheridan shares insights into the outlook for internet stocks in “Research Unplugged: 10 Internet Themes for 2026.”

The ‘AI Revolution,’ now 2.5 years old since the release of ChatGPT, continues to evolve. Jim Schneider illustrates shifts in AI model popularity in his latest note, “Semiconductors 2026 Outlook.” Current standout: GOOGL’s Gemini.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!