Hawkish Fed Shift

USDJPY is trading at its highest level since February ahead of the weekend, as USD continue to push higher. A hawkish shift in Fed rate expectations on the back of the FOMC this week has seen USD soaring higher. Alongside a fresh .25% rate cut, Fed chair Powell warned that further easing this year was not a done deal signalling heavy division among policymakers given the lack of data available currently due to the US govt shutdown. With rate cut probabilities plummeting on the back of that meeting, USD now looks poised for continued upside near-term, especially with the absence of data meaning there will be little to present a fresh case for Fed easing.

Intervention Risks & Hawkish BOJ Expectations

Despite the bullish shift in USD, a further rally in USDJPY isn’t clear cut. We’ve heard fresh warnings from Japanese finance ministers this week over the movements in exchange rates, suggesting that intervention could be coming. Additionally hotter-than-forecast Tokyo CPI overnight means that a furtehr BOJ rate cut this year now looks back on the table. JPY has been under heavy pressure over the last month mainly due to the shift in Japanese fiscal expectations on the back of new PM Takaichi taking over the LDP. Traders had been anticipating a dovish shift from the BOJ, in line with Takaichi’s support for greater fiscal expansion (dubbed Abenomics 2.0). However, with inflation data rising again and warnings over FX moves, a fresh rate hike now seems likely again.

Technical Views

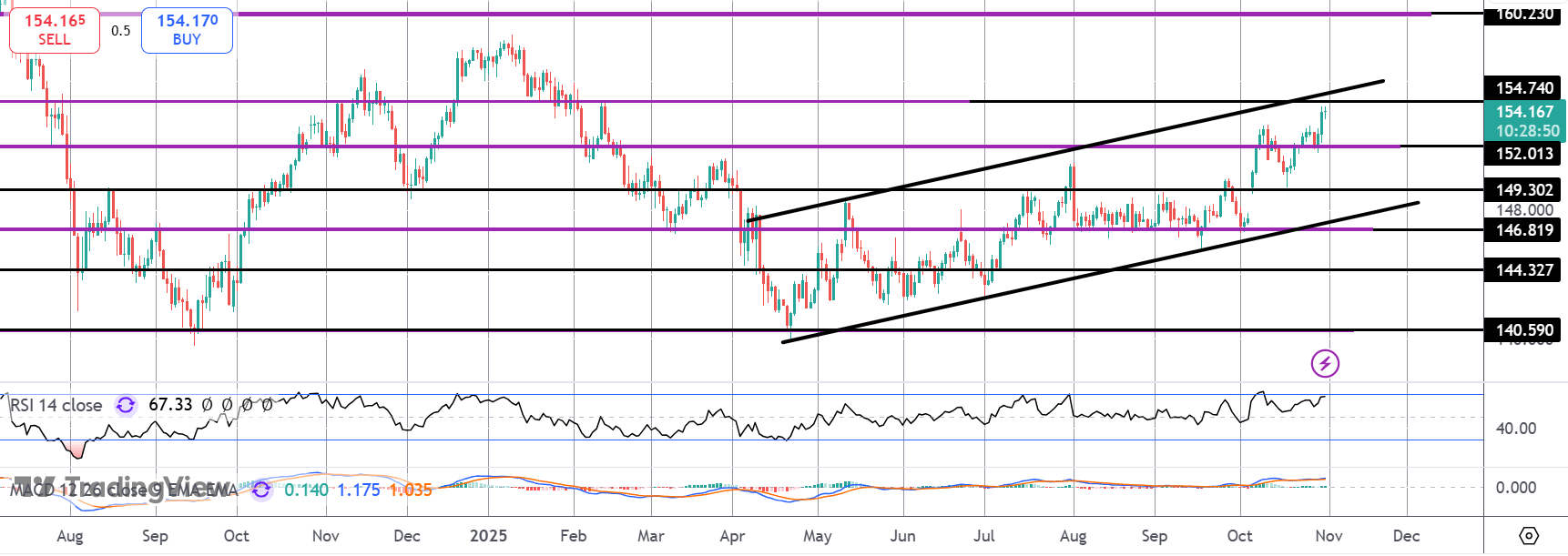

USDJPY

The rally in USDJPY has seen the pair trading up to test the 154.74 level and the bull channel highs where price is currently stalled. While above 152 and with momentum studies bullish, focus is on a continuation higher with 160 the longer-run target to note. To the downside, 149.30 will be the next support to note if we see any sharp move sub-152, for example in response to any intervention moves.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.