Institutional FX Insights: Goldman Sachs EUR & JPY Trading Views

USD: Maintaining Short USD Bias, Monitoring Month-End Risks

Market and FX volatility is stabilising this morning following yesterday’s significant moves, marking our third-largest day on record for eFX volumes. Overall, most clients were eager to capitalise on the USD’s movement, with the majority of supply concentrated early in the session. Despite this, the net flow bias remained tilted towards USD weakness, as evidenced by another downward drift into the 4 p.m. London fix.

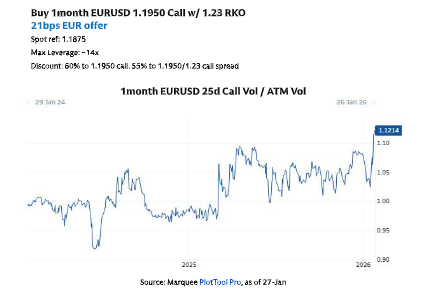

GS Trading continues to hold a short USD bias, primarily focused on EURUSD. However, barring any major new catalysts, they are likely to scale back some of their positions ahead of potential corporate month-end activity tomorrow. To complement cash positions, our preferred strategy for capitalising on further USD weakness is through topside EURUSD E/RKOs. This approach takes advantage of the still-elevated topside skew, particularly in contrast to the more subdued ATM vols, which have retraced yesterday’s moves more quickly.

JPY: Reduced USDJPY Short, Targeting 150-152, Fade Rebounds to 156/157

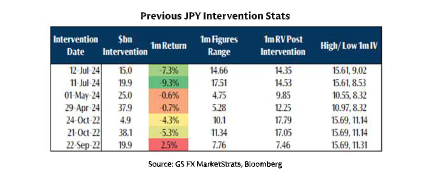

USDJPY briefly traded below the lower edge of the Ichimoku cloud at 153.65 but failed to close beneath it, indicating that the pair is likely to remain within the 153.65-156.10 cloud band in the near term. In this scenario, there is a risk of reducing recently accumulated JPY longs, particularly as election campaigning intensifies and fiscal policy discussions continue. We have trimmed most of our JPY longs and plan to fade any rebounds towards the 156/157 levels, targeting a move towards 150-152 in the coming weeks.

An additional risk to JPY longs lies in tomorrow’s 40-year JGB auction, which has already heightened market nervousness, with backend JGB yields rising approximately 5 basis points this morning.

Regarding BoJ policy expectations, last week’s sharp USDJPY decline reduced the likelihood of an accelerated hiking cycle, as the weaker currency has been a key driver of recent rate hikes. However, given the US’s potential influence (possibly allowing Japan’s Ministry of Finance to delay direct intervention), there is an expectation that Japanese authorities will need to stabilise backend JGB yields more effectively. This is due to their correlation with backend USTs and the broader impact on the US economy. To achieve this, accelerating the hiking cycle appears to be the most viable option, with the market now pricing in a 75% probability of a rate hike in April.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!